The Informed Investor

Tax Update: Adjusting for 2022

February 22, 2022

It is that time of year again. The IRS has released its 2022 annual inflation adjustments for many different provisions. In fact, over 60 tax provisions have been adjusted with this new release. Below we will review a summary of some of the newly released information so that you know what to look forward to in the coming tax season.

Standard Deductions

By far the most popular update on the list, the standard deductions which has increased for the 2022 tax year. For married couples filing jointly, the standard deduction is now $25,900. As for single taxpayers and those who are married filing separately, the standard deduction has increased $400 to $12,950. And, finally, all heads of households will see an increase of $600 for a standard deduction of $19,400 this tax season.

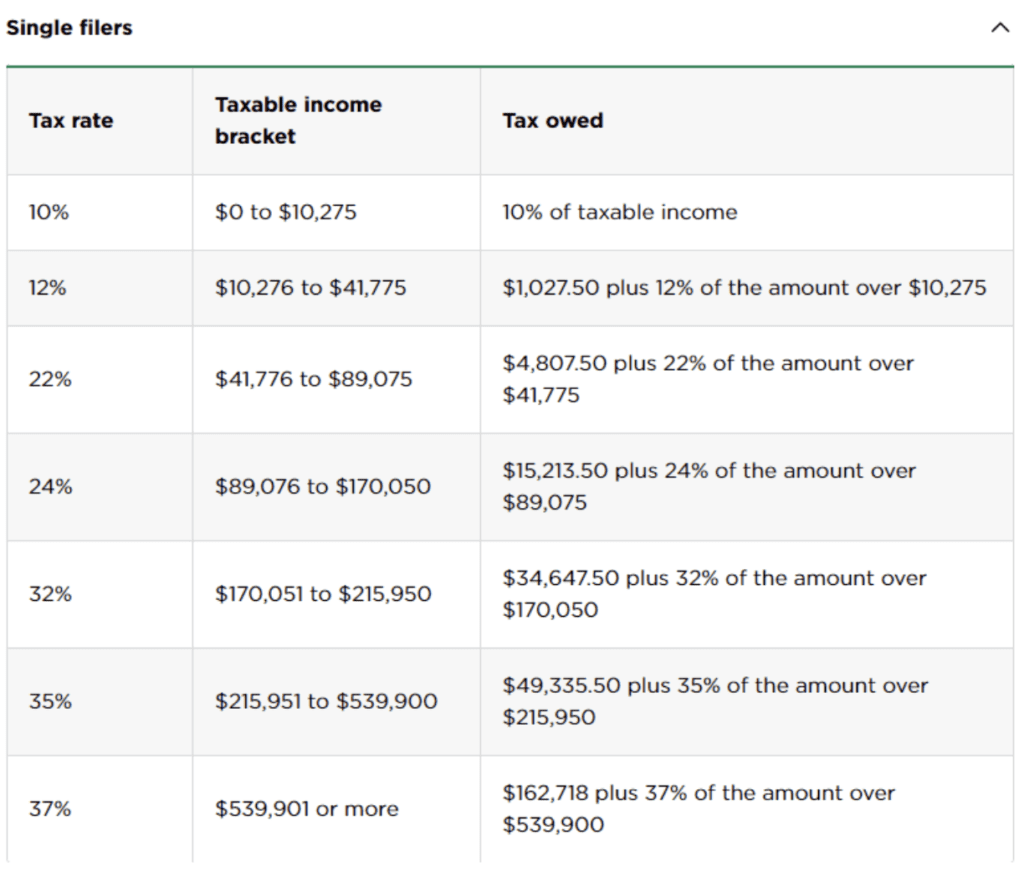

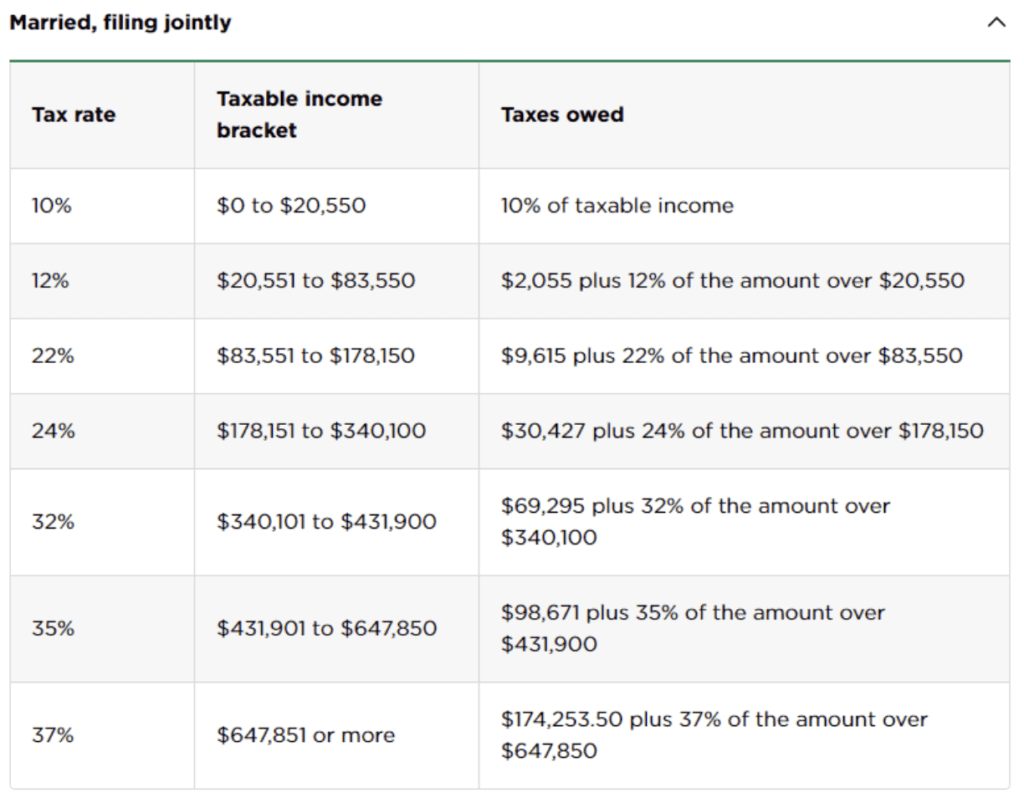

Individual Income Tax Brackets

Standard deductions for 2022 increase. Married couples get $25,900 plus $1,400 for each spouse 65 or older. Singles can claim $12,950 …. $14,700 if 65 or older. Heads of household get $19,400 plus $1,750 once they reach 65. Blind people receive $1,400 more ($1,750 if unmarried and not a surviving spouse).

Capital Gains

Tax rates on long-term capital gains and qualified dividends did not change fore 2022. The 20% rate starts at taxable income of $459,751 for singles and $517,201 for married couples filing jointly. The 3.8% surtax on net investment income is still applicable for 2022 for singles with modified AGI (Adjusted Gross Income) over $100,000 and $250,000 for married couples filing jointly.

Alternative Minimum Tax (AMT)

AMT exemptions rise for 2022 to $118,000 for couples and $75,900 for singles and household heads. The exemption phaseout zones start at $1,079,800 for couples and $539,900 for others. The 28% AMT rate kicks in above $206,100. The Alternative Minimum Tax exemption has changed a bit this year from what it was in 2021. This tax year, the exemption amount is $75,900 and begins to phase out at $539,900. For married couples filing jointly, the exemption amount is $118,100 and begins to phase out at $1,079,800. For single and head of household the AMT rae remains the same at 28%.

Charitable Donations

For 2022 tax returns, non-itemizers can no longer deduct up to $300 in cash donations paid to charity. The 60% of AGI limitation on cash charitable donations returns for 2022.

Estate Tax

The estate tax exemption amount for those who die during the year 2022 is $12,060,000.

Gift Tax

The annual exclusions for gifts increase from $15,000 in 2021 to $16,000 in 2022. Gifts valued at those amounts, or less, are not taxed. The IRS sets limits on how much you’re allowed to gift before you must file a return and before you are taxed. Sums over the annual thresholds are reportable and count toward a lifetime gift tax exemption amount. Once the lifetime gift tax exemption is exhausted, the gift becomes taxable. The lifetime gift tax exemption is the same as the estate tax exemption of $12,060,000.

Retirement Plans

The IRS has released the inflation adjustments for retirement plans. Below is an overview of the 2022 changes.

- The maximum Employee Elective Deferral Limit for 401(k), 403(b), and 457(b) Plans is $20,500 with additional catch-up contribution of $6,500 for individuals 50 or older.

- The maximum SIMPLE contribution increases to $14,000 for 2022 with an additional catch-up contribution of $3,000 for individuals 50 and older.

- The cap for traditional and Roth IRA contributions remains the same for 2022 at $6,000 with an additional catch-up contribution of $1,000 for individuals 50 and older. Deductible contributions to traditional IRAs phase-out with AGI more than $109,000 but less than $129,000 for married couples filing jointly and AGI more than $68,0000 but less than $78,000 for singles. Contributions to Roth IRAs phase-out with AGI more than $204,000 but less than $214,000 for married couples filing jointly and AGI more than $129,00 but less than $144,000 for singles.

- The maximum SEP-IRA and one participant 401(k) plan contribution amounts increase to $61,000 in 2022.

Required Minimum Distributions (RMD)

The starting age for RMDs changed in 2019. Anyone after 2019 is not required to take an RMD until the year he or she turns 72. The change does not apply to anyone taking an RMD in 2019 or before. In 2022 the life expectancy tables for calculating RMDs changed. The new tables allow RMDs to be spread out over more years.

Qualified Charitable Contributions (QCC)

Individuals 70 ½ and older may continue to donate up to $100,000 per year as a direct gift from their IRA to an eligible charity called a QCD. Once the individual reaches 72 the QCD may count as their RMD.

At ICC, we work with our clients’ tax professionals to proactively help manage tax strategies related to their investments. ICC does not provide tax, legal or accounting advice. This material is presented for informational purposes only.

If you have $1,000,000 or more in investable assets and would like to put our investment management expertise to work for you, contact us today at (702) 871-8510.

IMPORTANT DISCLOSURE INFORMATION

The Investment Counsel Company of Nevada (“Company”) is an SEC registered investment adviser located in Las Vegas, Nevada. Company may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Company’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Company’s web site on the Internet should not be construed by any consumer and/or prospective client as Company’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Company with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. A copy of Company’s current written disclosure Brochure discussing Company’s business operations, services, and fees is available from Company upon written request. Company does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Company web site or incorporated herein, and takes no responsibility, therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s).

Certain portions of Company’s web site (i.e. newsletters, articles, commentaries, etc.) may contain a discussion of, and/or provide access to, Company (and those of other investment and non-investment professionals) positions and/or recommendations as of a specific prior date. Due to various factors, including changing market conditions, such discussion may no longer be reflective of current position(s) and/or recommendation(s). Moreover, no client or prospective client should assume that any such discussion serves as the receipt of, or a substitute for, personalized advice from Company, or from any other investment professional. Company is neither an attorney nor an accountant, and no portion of the website content should be interpreted as legal, accounting or tax advice.

Please Note: Limitations: Neither rankings and/or recognition by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any professional designation, certification, degree, or license, membership in any professional organization, or any amount of prior experience or success, should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if Investment Counsel Company is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see below as to participation data/criteria, to the extent applicable). Unless expressly indicated to the contrary, Investment Counsel Company did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of Investment Counsel Company by any of its clients.

ANY QUESTIONS: ICC’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking. Please review Important Disclosure Information set forth in the last section of this website.