The Informed Investor

Las Vegas Financial Advisor Randy Garcia Updates Tax Advisors

January 20, 2020

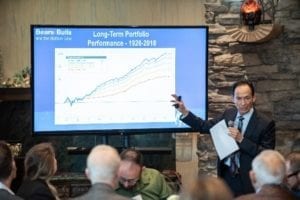

When Nevada’s top CPAs and tax advisors were seeking an expert to discuss today’s market, they reached out to Randy Garcia, a Las Vegas financial advisor. Randy is CEO of the Investment Counsel Company, one of the first financial advisors in Nevada to adopt the fiduciary standard. Randy presented at Fair, Anderson & Langerman’s 15th Annual Year-End Seminar. This annual breakfast was held in December 2019 at the Bali Hai Golf Course on the fabulous Las Vegas Strip.

As a fiduciary, fee-only wealth management firm, the Investment Counsel Company frequently partners with CPAs and tax accountants for the benefit of their mutual clients. By collaborating on both financial planning and taxes, these professionals can often find opportunities to save clients money, as well as pass on wealth more tax-efficiently.

Questions about Today’s Market

Randy’s presentation, entitled “Bears, Bulls and the Bottom Line,” covered the current state of the U.S. and world stock markets. Today’s market landscape seems volatile with geopolitical tensions and trade wars. However, the market has remained strong with positive economic undercurrents and low interest rates. But will the strength last? Clients have a lot of questions for both their tax advisors and financial advisors.

Randy’s message, from his firm’s 40 years of experience managing investor money: Tune out the noise.

In the old days, it was easier to turn down the volume of information coming at you. After all, you had to actively find a new source to get information. Long ago, that meant waiting for stock quotes in tomorrow’s newspaper. Today, with the rise of smartphones and the Internet, the news finds us. In fact, it’s hard to escape it.

It’s no wonder things are confusing for the average person. So how do professionals deal with this?

The answer is relatively simple. They use systems and discipline, instead of giving in to emotional urges to buy and sell. That can be hard to do if you have a busy life and are not a trained financial professional. That’s why most people find it beneficial to have a wealth manager that can help you stay on track when the markets get confusing. The best Las Vegas financial advisors are good communicators and are there to help you avoid those big mistakes, so you stay true to your goals.

This is especially advantageous in today’s environment, where we have low interest rates and U.S. stock indexes near record levels, making conservative income generation more difficult. That’s where smart tax strategies can benefit you.

In a high-risk environment, this is critical. You don’t see this emphasized on television because it’s not as exciting as dramatic moves, but these are the types of financial strategies that can help you build wealth and preserve what you already have. Over the long term, that’s what helps you achieve your goals.

Importance of Choosing the Right Professionals

Along with looking for professionals willing to collaborate with those already on your team, you need to pick your financial advisor carefully. There are two standards of advice: fiduciary and non-fiduciary. These two standards are very different and important for investors to understand.

A fiduciary financial advisor is legally required to put your interests first. That person must give you objective advice that is best for your situation, to the best of their abilities.

A non-fiduciary advisor, however, is not subject to that same requirement. In this case, you need to be on guard as you may not be able to tell if you’re receiving good advice or a product recommendation.

To learn more about choosing the right financial advisor, or about ICC’s wealth management services for high-net-worth individuals, families, and business owners, give us a call at 702.871.8510 today or visit us at iccnv.com.